As an entrepreneur, you have used your ideas, drive and ambition and grown your business so far using finance from

self, friends, family and your neighbourhood bank.

Perhaps your business has even reached break-even point and is already profitable. You are now considering leveraging

external capital for accelerating the future growth of your business. This is when you will come face to face with the hard realities

of fund raising.

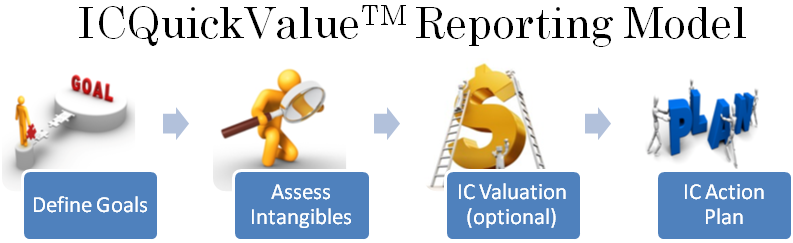

Discover your Intellectual Capital quickly with ICQuickValue™

ICQuickValueTM is a lightweight framework for quickly assessing

the Intellectual Capital of any business.

This framework enables us to quickly assess the intangible growth drivers of your

business and helps you formulate an action plan for managing and nurturing the same.

It also enables us to sharpen your pitch material during the fund raising process.

The scope of our services as part of the icFunding service includes:

- Investor material preparation

- Assesment of growth drivers using ICQuickValueTM

- Finalization of detailed business plan with inputs from you

- Preparation of the pitch collateral.

- Investor solicitation

- Shortlisting of the relevant investors

- Telephonic pitch to interested investors on your behalf

- Setting up meetings with investors to showcase the investment opportunity

- Structuring and negotiations

- Transaction structuring and negotiations on valuation

- Advising you on various clauses in the term sheet.

- Transaction closure

- Coordination during investor due diligence

- Coordination with financial and legal consultants to ensure closure of the deal

Read the sidebar to check whether you are ready to avail the icFunding service

for your growing business.